The 6Cs of Raising Capital Faster

The Six Keys to Closing Funds Faster With Bigger Investors.

So, you successfully raised capital. Congratulations! It was tough. It took a lot longer than you expected. You were turned down more than you care to admit. And, you are not particularly looking forward to having to do it again.

Before you know it, the time to start raising capital will be here again. If you are an emerging private equity firm, venture capital fund, or growth stage company, the move from the first to the second raise is a big one. We’ve seen many approaches to this transition with our growth-stage clients (some more successful than others) and have found the common threads that help you achieve the best outcomes. And by common threads, we mean putting the right communication infrastructure in place and maximizing your efforts every step of the way.

Here’s How: The 5+1 essential Cs to deploy to make your capital raise process easier, faster, and, more successful. These tips apply to Funds and growth-stage companies alike.

#1: CREDIBILITY: Understand the Needs of Your Audience

Most likely in Fund I, your LP base consisted primarily of High Net Worth (HNW) investors. Moving to Fund II, the mix of LP’s is going to change. Your LP base will now become a mix of High Net Worth investors, as well as larger institutional investors. Understand that these two investor types are quite different and have different needs. HNW investors tend to lean more heavily on issues around personal trust. Institutional investors lean more in the direction of domain expertise and proven success. You must adjust your message accordingly. In a perfect world, you would have two different strategies & matching pitch decks, one for each investor category.

Most High Net Worth investors want to understand your credibility. Essentially, they want to know if they can trust you. However, these investors are not known for performing much due diligence (if any in some cases). This type of investor will lean heavily on the power of their connections and their network to confirm your credibility.

Institutional investors behave very differently. Performing extensive due diligence is what they do, and most tend to do it well. Ensure that your fund has the proper infrastructure (people, processes, and data) in place ahead of time to help potential LPs with this process. If the proper infrastructure is lacking, and the due diligence process becomes difficult because of it, there is a high probability that your fund will lose that capital before you even get started. Marketing & Communications Infrastructure isn’t sexy but making sure it’s dialed in is vital. (pop quiz: does your website data feed your email and social data and your CRM? Who’s monitoring the network of your owned data to uncover usable insights? Do your platforms talk to each other? That’s marketing infrastructure.)

#2: COMMUNICATION: Heavily Engage your Investor Ecosystem

Potential institutional investors need to be comfortable with your team. To gain this comfort, they need to understand your view, your target market, your expertise, and your performance (among many other aspects of your fund). Branding and positioning play a vital role at this stage.

They can gain comfort only if the potential LP has had ample time to follow your team beforehand. One pitch meeting and a few follow-up emails are not going to be enough and doesn’t respect your LPs process. Your team’s burden is to establish the relationship early, broadcast your brand, and nurture the relationship through several touchpoints over time.

This process can take up to a year or more, so get started now. Build and nurture the ‘next-level’ investor ecosystem effectively, and you can potentially save your team countless hours raising the fund. Without question, not spending the appropriate effort engaging your investor ecosystem is the single largest mistake that we see funds make when raising Fund II.

#3: CALIBRATION: Size Your Fund Appropriately

A massive increase in fund size from Fund I to Fund II could be a potential yellow flag for institutional investors. Investors certainly expect the size of Fund II to grow – that is understandable. However, most potential investors will have strong opinions on how large that fund should be. Be prepared to defend any fund size decision you have made. In general, any increase in fund size that is 2X or 3X larger than the first fund will be heavily scrutinized by potential investors.

A massive increase in fund size is a hurdle that can be overcome, but the proof that it is appropriate must be strong. The team must articulate that a larger fund size will enhance the Fund’s return, not just make the Fund Partners more money in fees. The team must prove that a larger fund size is supported by the number of deals available, the team’s ability to execute on those deals, and that the company has the infrastructure to handle it. Finally, the team must prove that there is ample investor demand for a larger size. No one, particularly potential LP’s, wants to see the team in permanent ‘raise mode.’ LP’s want the team investing, not raising.

#4: CRAVE: Stay Hungry

Institutional investors want to partner with an investment team that is hungry for success. Potential LPs want to see an investment team passionate about working toward success in their domain. They want to be with a team that wants to win. In this case, winning translates to making money through investment performance, not management fees.

Like it or not, institutional investors will be very conscious of the Fund Partners’ lifestyle habits. They will look to lifestyle as a signal telling them if the Partners are still hungry. This perception may not be fair or warranted. However, Fund Partners should be mindful that this bias can exist among potential institutional investors.

#5: CHARACTER: Be the Franchise Fund Your LP’s Want

The last thing to keep in mind is that institutional investors don’t really like this process either. Sure, raising a fund takes far more effort from the investment team. However, it takes a lot of effort on the part of institutional investors as well. Most funds don’t think of the process from the LP’s perspective. Finding superior investment teams to back is not easy to do. Finding new investment teams to fund takes time, it takes effort, requires significant resources, and comes with a healthy dose of risk. Because of this, most institutional investors don’t like doing it.

Make their job easier for them. Make sure that they only have to underwrite your fund once. Be a franchise fund that they can continue to invest in through a series of funds. Be the long-term partner that they want. Institutional investors want to partner with a sustainable team, which works well together, are growing professionally, are building a great brand, are developing young talent, are incentivized, and are building a great COMPANY that will last for years and decades. That is what your LP’s want. Help them by becoming the franchise they trust through Fund II, III, IV, and beyond.

It will be here before you know it.

The time to raise additional capital will be here before you know it. Proactively prepare your company message, reputation assets, brand style, and marketing approach.

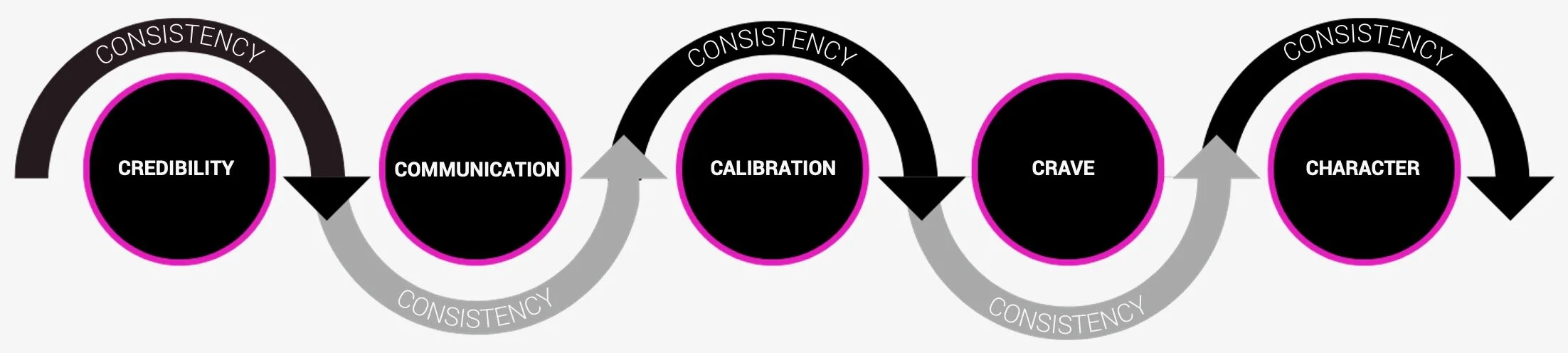

The key to the 6Cs working is actually the 6th C: Consistency.

Brands that are EBIT-positive are consistently reliable. It doesn’t mean you need to veer into ‘boring’ or ‘too much,’ instead, keep a pulse of on-brand communications flowing. You’re always-on.

“We found that as with consumers, business buyers’ purchase decisions tend to be a lot less value-driven than they like to think. Like consumers, professional buyers use the vendor’s reputation as a short cut that reduces risk and simplifies the evaluation process.” McKinsey & Company, The Value of B2B Branding.

CREDIBILITY: Understand your audience and message appropriately.

COMMUNICATION: Engage your investor ecosystem early and often.

CALIBRATION: Size your fund to enhance its potential return.

CRAVE: Make sure that investors understand that you are hungry to win.

CHARACTER: Finally, BE the long-term partner that your potential LP’s are seeking.

CONSISTENCY the flywheel that makes the other Cs valuable. It’s what strong brands are made of.

Follow these guidelines, and hopefully, it will make life a little easier for you and your team. Who knows, get these steps right, walk the walk, and investors may come looking for you on the next round.